Gold Prices Surge in Dubai: Record Highs Reshape the Market for Consumers and Investors

Gold Prices Surge in Dubai according to the global gold price trends reported by the World Gold Council, rising geopolitical risks and inflation fears have strengthened demand for gold worldwide. Analysts tracking the international gold market note that central bank buying and investor uncertainty continue to support high prices. In the UAE gold market, Dubai remains a key hub despite record retail rates, while many investors still view gold as a safe-haven asset during volatile economic conditions.

Prices have risen by around Dh50 per gram, pushing gold to record highs and significantly altering buying behaviour among residents, tourists, and investors alike. The spike reflects broader global economic pressures, geopolitical tensions, and shifting investment strategies.

Current Situation: What’s Happening in Dubai’s Gold Market?

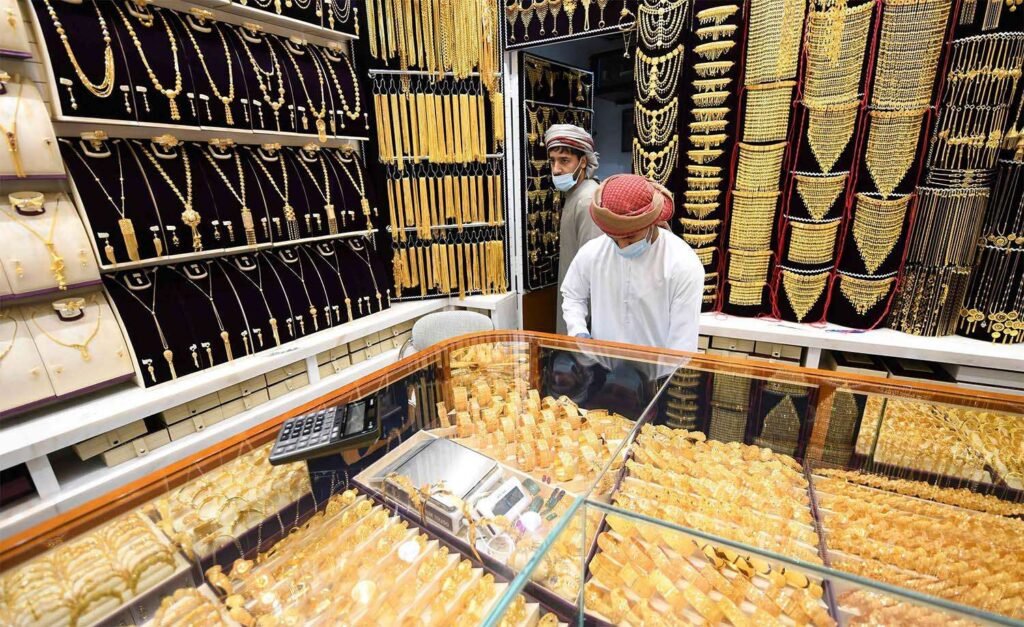

Gold retailers across Dubai’s traditional souks and modern malls report sharp daily increases in rates. Popular categories such as 22K and 24K gold, commonly used for jewellery and investment bars, have seen the steepest jumps.

This sudden rise has narrowed the price gap between Dubai and other global markets, reducing—but not eliminating—the city’s long-standing advantage as a gold-buying hub.

Key Reasons Behind the Sharp Price Increase

1. Global Economic Uncertainty

Gold prices typically rise during periods of economic instability. Concerns over global growth, inflation trends, and debt levels in major economies have pushed investors toward safer assets like gold.

2. Geopolitical Tensions

Ongoing conflicts, trade disputes, and diplomatic uncertainties across multiple regions have increased global risk sentiment. Historically, such conditions drive investors away from equities and toward precious metals.

3. Central Bank Buying

Central banks worldwide continue to increase their gold reserves to diversify away from currencies. This sustained institutional demand has added strong upward pressure on prices.

4. Currency Movements

A weaker performance or volatility in major global currencies often benefits gold. As gold is priced internationally, fluctuations directly impact local retail prices in Dubai.

5. Seasonal and Regional Demand

Dubai sees strong gold demand during:

- Wedding seasons

- Religious festivals

- Tourist peaks

When high global prices coincide with local demand cycles, retail prices rise more sharply.

Impact on Consumers

Higher Jewellery Costs

For residents planning weddings or festivals, jewellery bills have increased noticeably. Even lightweight designs now carry a premium compared to previous months.

Shift in Buying Behaviour

Consumers are adapting by:

- Choosing lighter or minimalist designs

- Opting for 18K gold instead of 22K or 24K

- Delaying purchases in anticipation of price corrections

Reduced Bulk Purchases

Bulk buying—once common among tourists and expatriates sending gold home—has slowed, with buyers spreading purchases over time.

Impact on Investors and Traders

Gold as a Safe-Haven Asset

For investors, the surge reinforces gold’s reputation as a hedge against:

- Inflation

- Currency depreciation

- Market volatility

Increased Trading Activity

Short-term traders are actively tracking daily price movements, seeking opportunities from volatility in bullion and gold-backed instruments.

Long-Term Investment Outlook

Many long-term investors remain confident, believing that persistent geopolitical risks and uncertain monetary policies will support elevated gold prices over time.

How Are Gold Retailers Responding?

Jewellers and bullion dealers in Dubai are adapting by:

- Offering promotional discounts on making charges

- Introducing buy-back and exchange schemes

- Promoting digital gold and investment bars for smaller-ticket buyers

These measures aim to sustain footfall despite high headline prices.

Should You Buy Gold Now or Wait?

For Jewellery Buyers

- If the purchase is essential, buying gradually or negotiating on making charges can help manage costs.

- Non-urgent buyers may prefer to wait for price stabilization.

For Investors

- Staggered investments (buying in intervals) can reduce risk.

- Long-term investors may still see value in gold as portfolio insurance rather than short-term profit.

Outlook: What Lies Ahead?

Gold prices in Dubai will remain closely tied to:

- Global inflation trends

- Interest rate decisions by major central banks

- Developments in global geopolitics

Any easing of tensions or clearer monetary signals could trigger temporary corrections. However, sustained uncertainty suggests prices may remain elevated in the medium term, even if short-term fluctuations occur.